MEC, or minimum essential coverage, is the amount of health insurance a person needs to have so that they don’t need to pay a penalty to the IRS for not having health insurance. Form 1095-B from the State of Iowa if you were a retiree the entire tax year or were enrolled in COBRA at the beginning of the tax year. What does the information on Form 1095-B mean? If you need a Form 1095-B you can call Medicaid at 1-88, email us at or visit a Medicaid office near you. Due to tax law changes1, the IRS says you no longer need Form 1095-B to file your federal income taxes if you bought your health plan on our Blue Cross and.

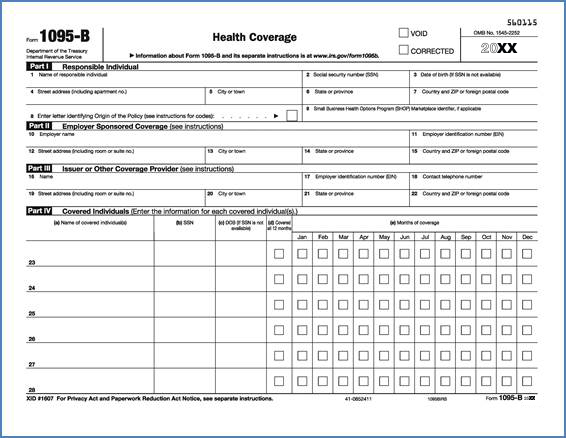

The IRS no longer imposes tax penalties for not having health insurance and is no longer requiring states to mail the Form 1095-B. Form 1095-C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a full-time employee for one or more months of the calendar. Members living in states with laws that require reporting of health coverage will continue to receive a paper copy of the Form 1095-B for state filing tax. Email the request to include your first name, last name, and date of birth.).Call Medicaid at 1-88 (Monday to Friday, 8 a.m.However, if you are in need of a copy of Form 1095-B or have questions regarding Form 1095-B, you can contact us in one the following ways: The IRS no longer imposes tax penalties for not having health insurance and no longer requires states to mail the form. Inst 1094-B and 1095-B: Instructions for Forms 1094-B and 1095-B 2022 Form 1095-B: Health Coverage 2022 « Previous 1 Next » Get Adobe ® Reader. Effective January 2020, Louisiana will no longer mail Form 1095-B to people who had MEC. If you received an Advance Premium Tax Credit, the information on the form will also help the IRS determine if you should repay any of the tax credit or receive. It shows that you and/or your dependents had MEC. Form 1095-B is used to report information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage. Form 1095-B is a health insurance tax form. Since January 2016, Medicaid and other health insurers have provided a Form 1095-B to people who had minimum essential coverage (MEC). If you or another family member received employer-sponsored coverage, that coverage may be reported on a Form 1095-C (Part III) rather than a Form 1095-B.

0 kommentar(er)

0 kommentar(er)