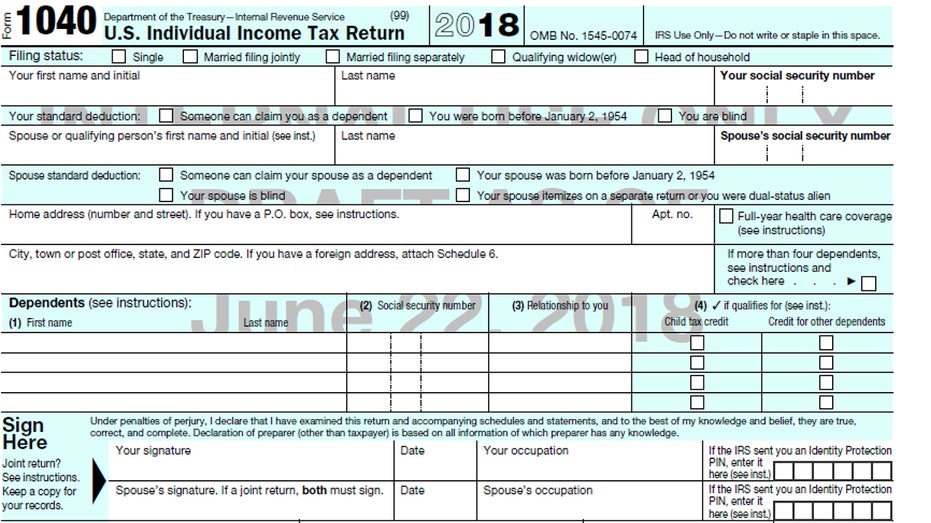

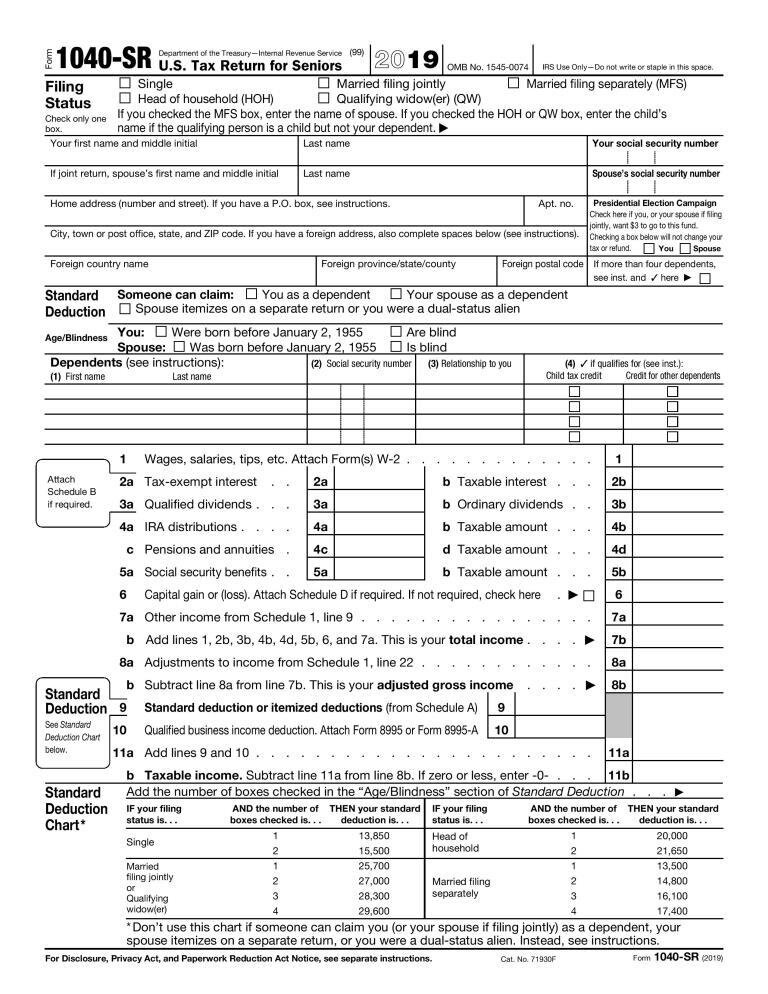

The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

taxpayers use to file their annual income tax return. If you are older than 65, you will have to file this form if your gross income was at least $25,700. The IRS 1040 form is one of the official documents that U.S. If you are a qualifying widow or widower and you are under 65, you will have to file this form if your gross income was at least $24,400. If you are older than 65, you will have to file this form if your gross income was at least $20,000. If you are the head of a household and you are under 65, you will have to file this form if your gross income was at least $18,350. If you are married and filing separately, you can be any age and you will have to file this form if your gross income was at least $5. If you and your partner were both over the age of 65, you will have to file this form if your gross income was at least $27,000. If one spouse was older than 65, you will have to file this form if your gross income was at least $25,700. If you and your partner were both under 65 at the end of 2019, you will have to file this form if your gross income was at least $24,400. Secondly, we look at those who are married and filing jointly. You may need to attach additional forms based on the income you report. Also, you will need to report any deductions and credits you are eligible to claim on the 1040 form. Use the 1040 form to report your tax information. Also unlike the other tax forms, IRS Form 1040 allows taxpayers to claim numerous expenses. It is also known as the long form because it is more extensive than the shorter 1040A and 1040EZ Tax Forms. For those in in this situation and over 65 at the end of 2019, you will have to fill this form if your gross income was at least $13,850. Individual Income Tax Return is an IRS-issued tax form for reporting personal federal income tax returns. The 1040 tax form is the standard form issued by the Internal Revenue Service (IRS). Form 1040 is the standard federal income tax form used to report an individual’s gross income (e.g., money, goods, property, and services). If your filing status is single and if you were under the age of 65 at the end of 2019, you will have to file this form if your gross income was at least $12,200. Form 1040 is the central part of tax filing for United States citizens. The schedule can seem challenging at first.

You can claim a deduction for your total when you complete the form. It provides details and numerical amounts for each of the deductions you’re claiming to reduce your taxable income. The large majority of US citizens will have to fill out the form 1040, and here we explain the various factors to be aware of. Schedule A is a tax form that must accompany your Form 1040 tax return if you choose to itemize your deductions.

0 kommentar(er)

0 kommentar(er)